Revenue Code 0111 is one of the most commonly used codes in hospital billing, especially for routine inpatient care. But many billing teams still misunderstand how it works, which can cause claim delays, underpayments, and compliance issues.

This easy guide will help you understand the purpose of Revenue Code 0111, when to use it, and how to avoid mistakes so your practice can stay paid correctly and on time.

What Is Revenue Code 0111?

Revenue Code 0111 is used for Inpatient Room and Board Medical/Surgical (Semi-Private).

It describes a routine inpatient bed where a patient receives care in a semi-private room (usually two patients in one room).

This code tells the payer what type of room the patient stayed in and helps determine the proper reimbursement rate.

Why Revenue Code 0111 Matters for Providers

For hospitals and inpatient facilities, correct use of this code helps:

1. Ensure Accurate Payment

Payers use room-type codes to calculate daily reimbursement. If you assign the wrong code, your payment may be lower than expected.

2. Keep Claims Clean and Fast

Incorrect room codes can trigger claim edits, slowing down your revenue cycle and adding extra administrative work.

3. Stay Audit-Ready

Auditors always check room-and-board codes. Using 0111 properly protects your facility from penalties and takeaways.

4. Build Trust with Payers

Consistent and accurate coding improves payer relationships and reduces denial risk.

When Should You Use Revenue Code 0111?

Use Revenue Code 0111 when a patient is formally admitted as an inpatient and receives routine hospital care. This code is meant for stays that do not require intensive monitoring or specialty units. It helps payers understand the level of care provided during a standard hospital admission.

Use this code when the patient stays in a semi-private medical or surgical room with two beds. This room type is commonly used for routine recovery and general treatment. It also reflects the facility’s standard accommodation level for non-critical patients.

This code should be used when the patient’s stay includes routine nursing care, daily meals, bedding support, housekeeping, and other basic services. All these services are grouped under room and board, so the code must match the room type. Using it correctly ensures accurate and timely reimbursement.

It should not be used for:

- ICU rooms

- Private rooms

- Nursery rooms

- Psychiatric rooms

- Intermediate or special care units

Example:

Imagine your hospital as your home.

Your guest has come to stay, and you offer them the shared guest room with two beds.

This “shared room” is the semi-private equivalent of Revenue Code 0111.

If you had given them a private room, the code would change.

So 0111 simply tells the payer:

“Patient stayed in the shared room.”

What Services Are Included Under Revenue Code 0111?

Revenue Code 0111 typically includes:

- Room usage (semi-private)

- Routine nursing care

- Basic supplies

- Dietary services

- Housekeeping

- Standard support services

These services are bundled, which is why the code must match the actual room type.

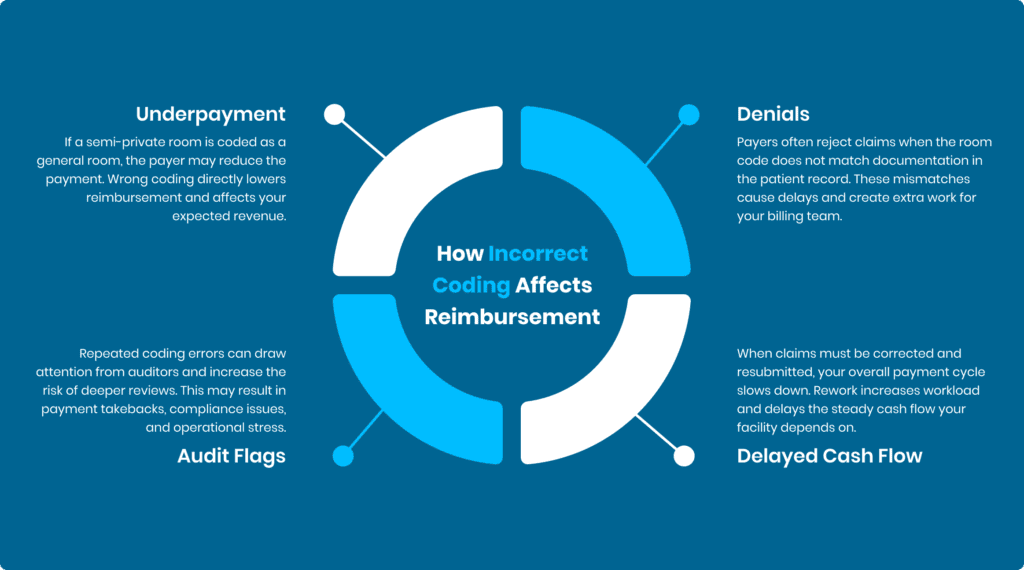

How Incorrect Coding Affects Reimbursement

Using the wrong revenue code—even by mistake can create several problems:

1. Underpayment

If a semi-private room is coded as a general room, the payer may reduce the payment. Wrong coding directly lowers reimbursement and affects your expected revenue.

2. Denials

Payers often reject claims when the room code does not match documentation in the patient record. These mismatches cause delays and create extra work for your billing team.

3. Audit Flags

Repeated coding errors can draw attention from auditors and increase the risk of deeper reviews. This may result in payment takebacks, compliance issues, and operational stress.

4. Delayed Cash Flow

When claims must be corrected and resubmitted, your overall payment cycle slows down. Rework increases workload and delays the steady cash flow your facility depends on.

Best Practices for Using Revenue Code 0111 Correctly

1. Verify Room Type Daily

Patients may move between different hospital rooms during their stay, so the room type must be checked every day. Update the revenue code to match the correct room assignment.

2. Match Coding with Documentation

Make sure the room listed in the EMR is the same one used for billing. Any mismatch between documentation and coded room type can cause denials or payment delays.

3. Pair With Correct HCPCS/CPT Codes (if needed)

Some payers ask for additional codes with room-and-board billing. Review each payer’s rules carefully so you only include extra codes when they are required for payment.

4. Train Billing Staff Regularly

Routine training helps billing teams stay updated on room-and-board coding rules. Well-trained staff make fewer mistakes and help keep your claims clean and accurate.

5. Review Payer Guidelines

Each payer may define room types or coding requirements differently. Keep their policies updated and accessible to ensure your team follows the correct billing process every time.

How Revenue Code 0111 Affects Reimbursement

Revenue Code 0111 directly impacts how payers calculate daily inpatient payment because it identifies the exact room type and level of routine care provided. Accurate coding ensures the reimbursement rate aligns with the services delivered during the patient’s stay.

When the wrong code is used, the payer may apply an incorrect rate, leading to reduced payment, claim delays, or additional reviews that slow down your revenue cycle.

Why This Code Is Important for Provider Revenue

Room and board make up a major part of inpatient billing, often more than medications or procedures. Correctly using Revenue Code 0111 ensures charges reflect the actual level of care provided.

Accurate coding protects your hospital’s revenue by matching documented services with payer expectations. It also helps maintain strong compliance, reduces audit risks, and supports a smoother billing workflow for your team.

Clean claims improve operational efficiency and help build trust with insurance payers. Fewer errors mean faster payments, less rework, and a more stable revenue cycle, benefiting both the facility and billing staff..

Conclusion

Revenue Code 0111 may look small, but it plays a big role in inpatient billing. By understanding when and how to use it, healthcare providers can improve reimbursement accuracy, avoid denials, and stay audit-ready. A little attention to this code can significantly strengthen your revenue cycle and save your team time and stress.

At Paymedics, our professional billing team helps clients professionally handle billing related issues and enhnce practice revenue without compromising patient care.

FAQs

What does Revenue Code 0111 mean?

Revenue Code 0111 represents a medical/surgical semi-private inpatient room. It is used for routine room-and-board billing for two-bed hospital rooms.

When should providers use 0111?

Use it when a patient stays in a semi-private inpatient room and receives routine care.Do not use it for ICU, private, or specialty rooms.

What happens if 0111 is coded incorrectly?

Incorrect coding may cause underpayment or claim denial. It also increases audit risk and delays payments.

Does 0111 include special nursing services?

No, 0111 includes routine nursing care only. Special services must be billed separately when applicable.

Can room-type changes impact revenue codes?

Yes, every room change must be coded correctly for each day. Wrong codes can reduce reimbursement or cause denials.