Revenue Code 0101 often feels confusing for many providers because every payer has slightly different expectations. When rules are unclear, small mistakes easily happen, causing claim denials, long delays, and extra rework for your billing team.

This guide explains important details about the Revenue Code 0101, its importance in the medical billing and how providers can use it correctly.

What Revenue Code 0101 Actually Means?

Revenue Code 0101 is used to represent standard medical/surgical services within a general inpatient room and board setting. It is part of the “0100 room and board category, but 0101 specifically refers to regular medical or surgical care, not intensive or specialized care.

When a patient stays for treatment that does not require ICU, special care, or psychiatric care, 0101 is typically assigned. It captures the cost of nursing services, general supplies, and routine room use under a medical/surgical environment.

Importance of Revenue Code 0101

Payers often deny claims with 0101 if:

- The room type does not match the documentation

- The length of stay does not align with clinical notes

- Supporting codes are missing

- The payer requires a different room category

When claims are denied, staff lose hours correcting and resubmitting. This slows down revenue, increases workload, and affects month-end performance.

But when Revenue Code 0101 is assigned correctly, you enjoy smoother claim processing, fewer rejections, and more reliable reimbursements.

How to Use Revenue Code 0101 Correctly

The key to correct use is making sure the patient’s stay truly represents a general medical/surgical level of care. Always confirm what the payer considers “general care.” Some payers group it differently or expect more detailed documentation.

Here are a few everyday-style examples to simplify it:

- A patient recovering from an appendectomy staying in a standard room → 0101

- A patient treated for pneumonia with regular nursing care → 0101

- A patient admitted for dehydration and rehydration therapy in a general room → 0101

If the patient requires constant monitoring, specialized beds, or intense nursing involvement, the code may change. Therefore, healthcare provdiers should pay attention when assigning codes or they can coordinate with expert billing profesionals to handle billing related matters.

Common Reasons Claims With 0101 Get Denied

Many providers face denials because of mismatched documentation or misunderstanding payer-specific rules. Even a small detail can cause issues.

Some of the common reasons include:

- Missing physician progress notes supporting medical/surgical care

- Incorrect pairing with other revenue codes

- Room type mismatch (e.g., special care room billed as general care)

- Using 0101 for observation instead of inpatient

- Payer requires detailed itemization alongside 0101 but it wasn’t submitted

These denials are avoidable when the billing team has clear direction and reviews the payer’s manual for that state or plan.

Difference between Revenue Code 0101 and 0100

This is one area that creates confusion for many billing teams, so let’s simplify it clearly.

Revenue Code 0100

0100 is a general catch-all code for room and board. It does not specify the clinical level of care. Some payers accept 0100 when the level of care is unclear or when they expect charges grouped under a general category.

Revenue Code 0101

0101 is specifically for medical/surgical inpatient care. It tells the payer exactly what type of room and treatment environment the patient received.

Simple Comparison

Imagine your home:

- 0100 is like saying “a family member stayed in a room.”

- 0101 is like saying “they stayed in the bedroom used for medical recovery.”

Using the wrong one can cause denials because the payer expects a specific category. Always check the patient’s actual clinical level of care before assigning.

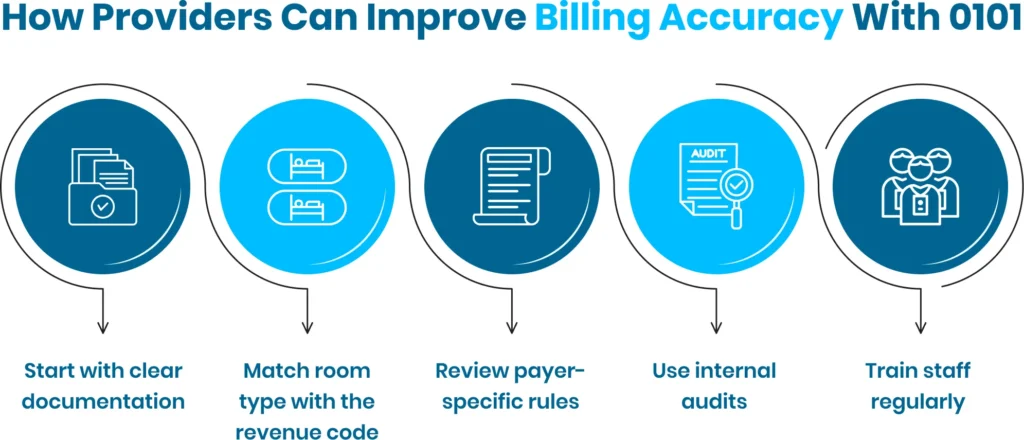

How Providers Can Improve Billing Accuracy With 0101

Better accuracy starts with a strong workflow. Here is a smooth, realistic approach any billing team can apply:

- Start with clear documentation

The nursing team must document the patient’s level of care consistently. If the notes mention medical/surgical care, 0101 becomes appropriate. - Match room type with the revenue code

If the floor is designated as a medical/surgical unit, your revenue code should reflect that. Payers compare physical room type with the code used. - Review payer-specific rules

Some insurance plans require extra detail. Before submitting, confirm if the payer wants extra codes, itemized lists, or supporting charges. - Use internal audits

A simple weekly review of a few 0101 claims helps catch repeating mistakes. Hospitals using internal audits see faster improvements in clean claim rates. - Train staff regularly

Coding rules change. A short 15-minute refresher every month keeps staff updated and aware of payer trends.

How Revenue Code 0101 Optimizes Revenue Cycle

Every clean claim speeds up your payment and reduces the carrier’s chances of flagging your account for additional audits. When you consistently use 0101 correctly, you build payer trust. This leads to:

- Reduced denial rates

- Faster turnaround time

- Lower administrative costs

- Better month-end performance

- Improved financial stability

Think of it like keeping your home organized. When everything is in the right place, the whole family moves smoother. In the same way, accurate coding keeps your revenue cycle running smoothly.

Conclusion

Revenue Code 0101 plays a big role in inpatient billing. When used correctly, it avoids denials, speeds up payments, and strengthens your revenue cycle. Providers who understand payer expectations and ensure consistent documentation get paid faster and with fewer headaches.

Your billing team can easily master this code with simple training, clear rules, and regular checks. Once they do, you will notice a clear difference in your cash flow and claim success rate.

Frequently Asked Questions

What is Revenue Code 0101 used for?

Revenue Code 0101 is assigned for standard medical or surgical inpatient room and board services in general care hospital units.

Why do claims with 0101 get denied?

Denials happen when documentation, room type, payer rules, or level of care do not match the medical or surgical category.

Can Revenue Code 0101 be used for observation?

No, observation services are not billed under 0101; they require different revenue codes based on payer guidelines.

What is the difference between 0101 and 0100?

0100 is a general room and board code, while 0101 specifically represents medical or surgical inpatient services.

How can providers reduce denials with 0101?

Ensure documentation accuracy, match room type, follow payer rules, conduct audits, and train billing staff regularly.