Revenue Code 0100 is often confusing for providers because it’s used differently depending on the payer and the patient’s situation. This confusion leads to coding errors, resulting in payment delays, denials, and additional administrative work.

To help providers avoid these issues, this guide explains all about the Revenue Code 0100 so you can use it confidently in your daily billing process.

Example:

Imagine a patient admitted without a confirmed room type. If your team selects the wrong code instead of 0100, the payer delays payment and requests extra documents, increasing workload.

What Is Revenue Code 0100?

Revenue Code 0100 represents All-Inclusive Room and Board services. It is commonly used when the payer or billing method requires a single, bundled charge instead of breaking room and board services into multiple categories.

In simple words, 0100 is used when:

- A patient receives general inpatient care

- No special care room category applies yet

- The hospital charges one combined fee for room and board

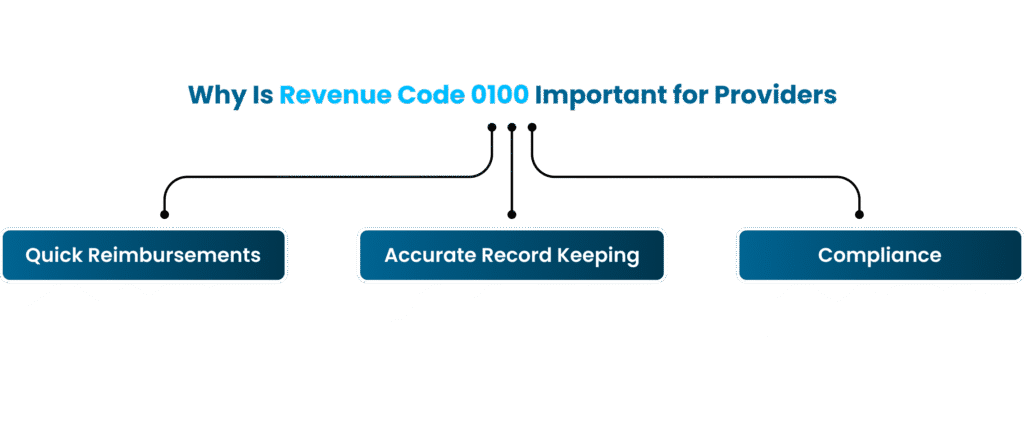

Why Is Revenue Code 0100 Important for Providers?

Revenue Code 0100 plays a key role in clean and accurate billing. Using it correctly prevents avoidable mistakes, supports proper documentation, and ensures room and board charges match payer expectations. This helps providers protect payments and reduce administrative stress.

- Reduce claim denials

- Speed up reimbursements

- Maintain clean and accurate billing records

- Avoid compliance issues caused by incorrect room classifications

Common Situations Where 0100 Is Used

Revenue Code 0100 is typically used when a patient receives general inpatient care, especially when the final room type or specific unit has not been confirmed yet.

- General inpatient stays

Used when a patient is admitted for routine inpatient care and no specialty unit or specific room category applies during the initial stay. - Short admissions where the payer requires an all-inclusive rate

Applied when payers prefer a bundled single charge instead of separate room and board charges for brief inpatient stays. - Situations where the patient’s room level is not yet determined

Used when the patient is admitted but their final room classification is pending, ensuring clean billing without premature room coding. - Bundled payment models

Fits payer contracts that require combined inpatient charges under one code, helping providers submit simplified, compliant bundled claims.

How Revenue Code 0100 Helps Avoid Denials?

Revenue Code 0100 is commonly used during general inpatient care when the patient’s final room type or unit hasn’t been confirmed. It supports billing teams by giving them a safe, general code until a specific room category is assigned.

General inpatient stays are the most common use case. Providers choose this code when a patient receives routine care without being placed in a specialty unit.

For short admissions requiring an all-inclusive rate, 0100 helps create a single, clean charge. It also works well when the room level is still pending, or when bundled payment models require combined inpatient charges.

Documentation Tips to Support Revenue Code 0100

Proper documentation is essential when using Revenue Code 0100, it helps payers understand the patient’s stay clearly. Clean and complete records reduce denials, support medical necessity, and show why the all-inclusive room and board code was used.

When your team provides accurate details, the claim becomes easier to review and process without delays.

- Admission type and date

- Medical necessity

- Physician order

- Length of stay

- Any room changes that happened later

How to Pair Revenue Code 0100 Correctly?

When using Revenue Code 0100, always review the payer’s guidelines because each payer may expect different billing requirements. Some payers accept 0100 without additional codes, while others want supporting charges or specific billing formats.

Understanding these rules helps prevent coding mistakes, reduces denials, and ensures your inpatient claims are processed smoothly.

- No specific CPT codes

- Attached UB-04 general charges

- Per-diem calculations

- Bundled billing guidelines

Incorrect pairing is one of the biggest reasons for denials. Get in touch with leading denial management experts to avoid claim rejection and boost practice revenue

Example:

A patient is admitted for routine inpatient care, but the payer requires per-diem billing. If your team uses Revenue Code 0100 without checking this rule, the claim gets denied instantly.

Best Practices for Providers Using Revenue Code 0100

Here are easy habits your billing team should follow:

- Verify payer rules before assigning 0100

- Cross-check documentation with the admission notes

- Avoid specialty room codes unless required

- Use 0100 only when general inpatient care applies

- Match charges exactly with the UB-04 claim form

- Maintain internal audits every month to catch errors early

Benefits of Correctly Using Revenue Code 0100

Using Revenue Code 0100 correctly helps providers keep their claims clean, accurate, and easier for payers to review. It reduces preventable billing issues, minimizes delays, and protects overall reimbursement.

When documentation and coding match payer expectations, the entire billing workflow becomes smoother, faster, and more reliable for your team.

Faster reimbursements

Correct 0100 usage ensures payers receive complete, accurate information the first time, allowing claims to process quickly.

Fewer appeals

Accurate coding prevents avoidable denials, reducing the need for time-consuming appeals, correction cycles, and additional documentation follow-ups that slow down reimbursement.

Clean claim submission

When 0100 is used appropriately, your claim stays clear, organized, and fully supported, increasing acceptance rates, avoiding errors that commonly trigger payer scrutiny.

Compliance

Proper use of 0100 ensures your billing aligns with payer policies, documentation standards, and regulatory expectations, helping your organization stay compliant.

Higher revenue capture

Correct coding prevents missed charges and underpayments, ensuring the full inpatient room and board value is billed and collected without financial leakage.

Conclusion

Revenue Code 0100 may look simple, but it plays a powerful role in clean hospital billing. When used correctly, it helps providers avoid denials, ensure accurate payment, and stay compliant with payer rules.

By understanding when to use this code and when not to use it, you can keep your revenue cycle strong and predictable. At Paymedics, we empower clients with modern billing solutions designed to help them accomplish financial excellence

Frequently Asked Questions

What does Revenue Code 0100 mean?

Revenue Code 0100 represents all-inclusive inpatient room and board charges used when no specific room category or unit applies.

When should providers use Revenue Code 0100?

Use it for general inpatient stays where bundled room and board charges apply and no specialty care room is required.

Can Revenue Code 0100 cause denials if misused?

Yes, incorrect use can cause claim denials, delays, underpayments, and additional documentation requests from payers reviewing room classification accuracy.

Which payers commonly accept Revenue Code 0100?

Most Medicare, Medicaid, and commercial payers accept 0100 for properly documented general inpatient stays using bundled room and board charges.

What documentation supports Revenue Code 0100?

Accurate admission notes, physician orders, medical necessity details, and clear room assignment information help fully support 0100 billing claims.